NewsVoir

Bengaluru (Karnataka) [India], October 24: The Goods and Services Tax (GST) has been a game-changer in India’s taxation system since its rollout in 2017. After almost two decades of deliberation and planning, the country adopted a unified tax structure aimed at simplifying the complex web of state and central taxes.

But the journey of GST has been anything but smooth. With its ups and downs over the past eight years, the Indian government is now implementing Next-Gen GST Reforms in 2025. These reforms are designed to simplify the tax system further and make life more affordable for the common man. But will the benefits really reach you, or will this just be another step in the government’s long-term economic strategy? Let us break it down.

1. Simplified Tax System: What’s Changed?

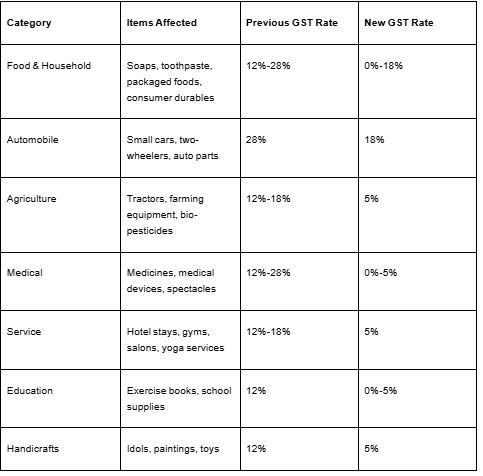

One of the biggest changes with the 2025 GST reforms is the shift to a simplified two-slab tax system: 5% and 18%. Previously, the system had multiple slabs ranging from 0% to 28%. This reduction in the number of tax slabs aims to make the taxation process easier for businesses and consumers alike.

This also means that the everyday items we can’t live without, like soap, toothpaste, and packaged foods, well, the good news is that their GST has been slashed to either 5% or even 0%. That means, in simple terms, these essentials could cost you less, which makes a real difference when you are managing your household budget.

When it comes to medicines and medical devices, the GST has been brought down from 12% to 5% or Nil. For anyone who relies on regular medication, this is huge. It makes life-saving drugs and healthcare products much more affordable and accessible, especially for those who need them most.

2. Will the Price Reductions Actually Reach You?

Although the GST reforms promise to bring down prices, there’s still a big question: Will we actually see those savings at the checkout?

Here’s the thing — businesses are the ones in the middle. The government can lower taxes, but it’s really up to the businesses whether they’ll pass on those savings to you or keep them for themselves. In the past, we’ve seen some price cuts trickle down, but not always. So, while the tax cuts are there, whether you feel them in your wallet depends on how quickly and fully businesses adjust their prices.

This isn’t just limited to a few sectors. Whether you’re shopping for a car, a phone, or even your groceries, the experience can be a bit hit or miss. For example, when the GST on cars and two-wheelers was reduced from 28% to 18%, we were all expecting lower prices. But many car manufacturers didn’t immediately lower their prices, and some didn’t pass on the full benefit to customers. As a result, consumers didn’t feel that reduction in their pockets right away.

A LocalCircles study found something similar with essential food items. Even though GST cuts were implemented, many consumers reported not noticing a difference in prices at the store. Why? Because sometimes, manufacturers or retailers choose to keep prices steady or adjust them slowly, which delays the savings reaching the customer.

Key Insight: While the GST reforms are a step in the right direction, the real benefit will depend on how businesses adapt and whether they pass the reductions on to customers quickly and uniformly.

3. Impact on Local Businesses and Employment

Beyond just affecting prices for consumers, the GST reforms also aim to give a boost to small businesses (MSMEs). By making tax filing simpler and cutting down on compliance costs, these changes are especially helpful for sectors like handicrafts, small manufacturing, and agriculture. Lower GST rates on raw materials mean these businesses can cut their costs, too.

With reduced GST on things like cement, iron, and farming equipment, local businesses can lower their operational costs. As a result, they become more competitive and can offer lower prices on goods and services. So, you could see your everyday purchases becoming more affordable.

When businesses save on costs, they can ramp up production, which boosts demand. And as demand increases, it could lead to more job opportunities especially in rural and semi-urban areas, where small businesses are the backbone of the economy.

Take the reduction of GST on tractors and irrigation tools from 12% to 5% which is expected to lower farming costs. This could result in cheaper farm produce, thus benefiting consumers while also making farming more sustainable.

4. Long-Term Benefits: Economic Growth and Household Savings

The government’s goal with these reforms is not just to lower immediate costs, but to also stimulate long-term growth. The logic behind reducing taxes on essential goods is that by making life more affordable, families will have more disposable income, which they can either save or spend on other goods and services. This increased demand can stimulate economic growth.

According to the Ministry of Finance, GST collections have hit record highs, showing steady growth. This reflects not just stronger compliance but also an uptick in economic activity. As more businesses come under the formal GST system, the tax base expands, which means more funds are available to support public services and welfare initiatives.

While the GST reforms of 2025 have the potential to significantly benefit the common man, especially through price reductions on essentials, the true success will depend on how businesses, consumers, and government agencies adapt. The common man must stay informed, not just about GST rates but also about how these changes affect the prices of goods and services in their daily life.

To truly understand and take advantage of these reforms, financial literacy is key. With better knowledge of taxes, savings, and how these reforms will impact various sectors, consumers can make informed decisions, thus ensuring that the full benefits of GST reach their pockets. The reforms are a step forward, but only through awareness can the common man fully realize their potential.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by NewsVoir. ANI will not be responsible in any way for the content of the same.)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages