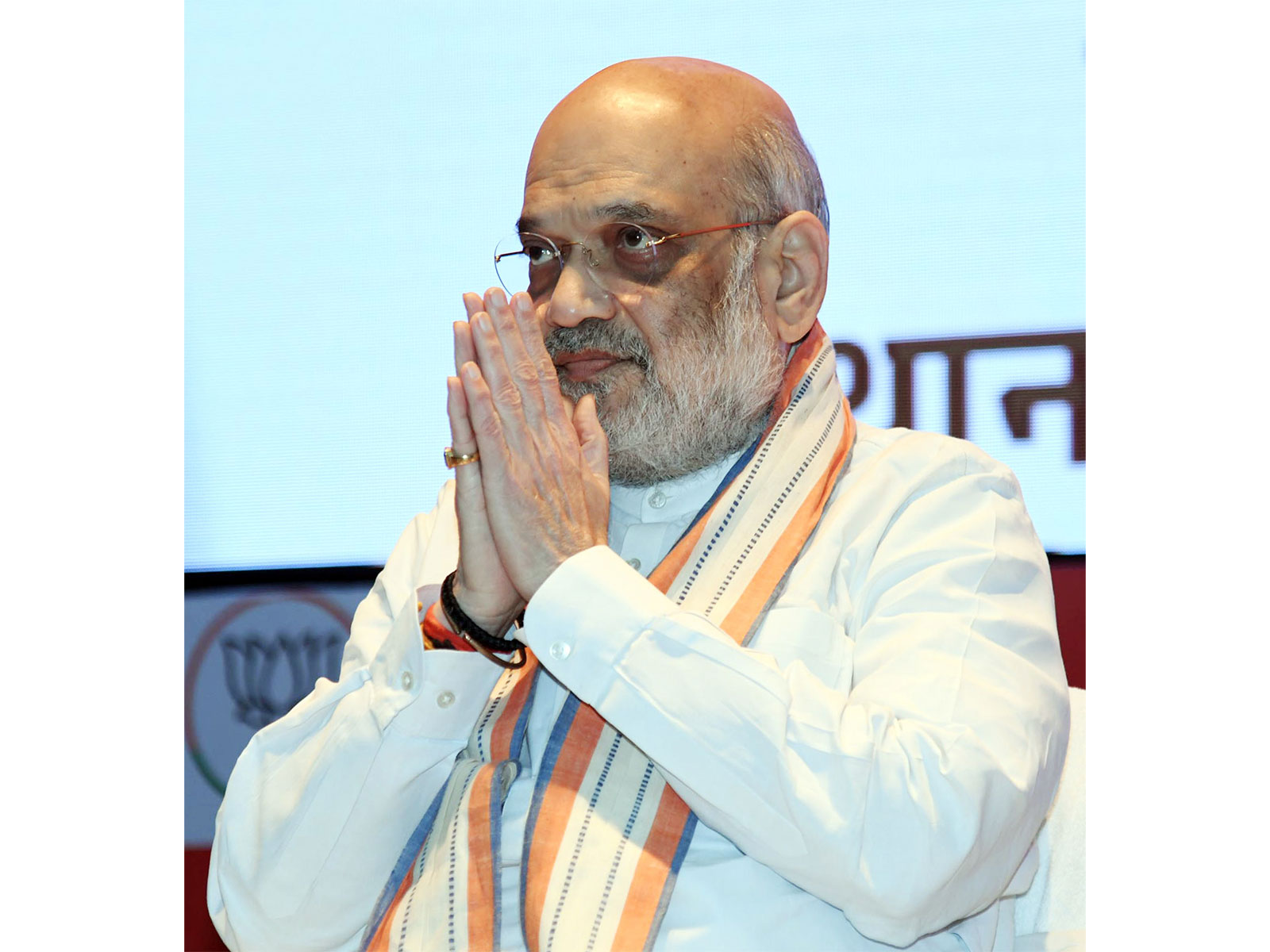

New Delhi [India], October 31 (ANI): Union Home and Cooperation Minister Amit Shah will inaugurate the “CO-OP Kumbh 2025,” an international conference on Urban Cooperative Banks, to be held at Vigyan Bhawan, New Delhi, on November 10 and 11, 2025. The two-day event is being organised by the National Federation of Urban Cooperative Banks and Credit Societies (NAFCUB) to mark the “International Year of Cooperatives,” according to a release by the federation.

NAFCUB President Laxmi Dass said that the event will bring together key stakeholders from the cooperative banking sector in India and abroad. Around 1,200 chairpersons and CEOs of urban cooperative banks have already confirmed their participation. “It will be one of the largest gatherings of stakeholders in the cooperative credit sector,” the release stated.

The concluding session of the conference will feature a lecture by the Union Minister of Commerce and Industry, Piyush Goyal. The event will also see participation from senior experts from the Reserve Bank of India, nationalised banks, and the Ministry of Cooperation, who will address issues shaping the future of the cooperative banking industry.

The “CO-OP Kumbh 2025” will focus on how technology is transforming cooperative banking. NAFCUB will organize a CEO panel discussion to bring together leaders from top Indian banks to discuss digital transformation, artificial intelligence, financial inclusion, and policy developments. “A roadmap for the future of the cooperative banking industry will be laid out,” the release said.

The conference will also explore key topics, including AI-driven banking, open finance, and digital identity. It will provide a networking platform for experts in fraud prevention to discuss the latest trends and challenges, including cyber threats and compliance risks like anti-money laundering (AML) and know-your-customer (KYC) norms.

According to NAFCUB, “CO-OP Kumbh 2025” aims to help urban cooperative banks strengthen their operational resilience against technology and cyber-related risks. It will also create opportunities for banks to explore new financial technologies and build partnerships that can support the next phase of growth in the cooperative credit sector. (ANI)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages